Is affordable housing in Fort Collins disappearing?

Low inventory and rapid appreciation continue to characterize the Northern Colorado Real Estate market. The median sale price in the city of Fort Collins was $256,000 in the 4th quarter of 2013, while the 4th quarter of 2014 saw a median sale price of $286,000–that’s a 15.6% increase. It’s no wonder prices are up again when you see that the number of homes for sale at the end of 2014 is 20% less than it was a year ago.

Low inventory and rapid appreciation continue to characterize the Northern Colorado Real Estate market. The median sale price in the city of Fort Collins was $256,000 in the 4th quarter of 2013, while the 4th quarter of 2014 saw a median sale price of $286,000–that’s a 15.6% increase. It’s no wonder prices are up again when you see that the number of homes for sale at the end of 2014 is 20% less than it was a year ago.

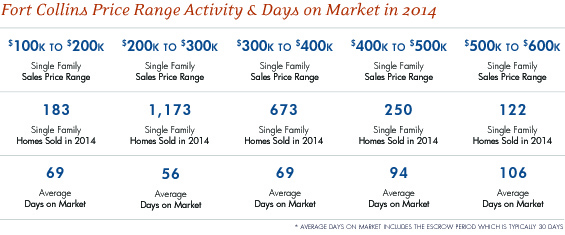

Some of us in the industry guessed that prices and demand would soften once the new construction ramped back up after the recession. Just a few years ago, a glut of shiny new builds priced in the low and mid $200k range was enough to tempt buyers away from the resale market and keep inventory at a healthy level. Unfortunately, these new, affordable homes are a thing of the past, providing further strain on the already red-hot and rapidly disappearing $200k market. In 2014 there were 49% fewer homes sold under $250,000 than there were in 2013. Currently, the cheapest, available new construction in the city can be found in Ridgen Farm where 1,700 finished square feet is selling for $294,000. The median price for new construction in the city is $390,000.

With about 1,000 new single family units built in 2014 and 14 residential developments under review for approval by the city, additional inventory is in our future. But with the majority of those units priced at $350k and up, we expect the market for homes below $350k to remain extremely competitive. Homes in the $400k range should moderate through 2016 and potentially slow in 2017 as new developments are completed.

Currently, Fort Collins adds between 2,500 and 4,000 new residents each year. With 3 people in the average family unit that equates to between 830 and 1,300 new dwelling units needed per year.

Contrary to rumors we hear regularly, a huge variety of mortgage programs are still available to buyers. Loan programs currently allow qualified buyers to put down as little at 3.5% and borrow 96.5% of the value of a home provided the property is their primary residence.

Share This Post

| Previous Post | Next Post |